Maximizing Efficiency with Compliant Mining Machine Hosting Solutions

Imagine running a high-stakes mining farm where operational hiccups can cost thousands, if not millions, of dollars every hour. **The race isn’t just about hashing power anymore—it’s about optimizing every micron of your setup while staying on the right side of compliance.** Mining machine hosting solutions are no longer optional luxuries; they’re strategic imperatives in 2025’s cutthroat crypto mining arena.

At the heart of mining ventures—be it BTC, ETH, or DOG—lurk challenges that only professional hosting can mitigate. We’ve seen instances where poorly managed miners led to overheating, unexpected downtime, and regulatory penalties that shredded profit margins overnight.

Let’s unpack the synergy between compliance and efficiency in mining hosting, weaving in the latest insights from the International Blockchain Association’s 2025 Mining Outlook report, which asserts that **compliance-minded hosting farms outperform traditional setups by up to 23% in operational uptime and energy efficiency.**

The Theory: Compliance as a Catalyst for Efficiency

Conventional wisdom may paint compliance as a bureaucratic drag, but cutting-edge research reveals the opposite. When mining farms integrate compliance protocols—ranging from environmental impact standards to data security mandates—they naturally boost operational rigor. This, in turn, sharpens efficiency across the board.

Consider the case of a mid-sized Ethereum mining rig operator in Iceland. By adopting hosting services adhering strictly to Nordic environmental laws and international data protection policies, the operator not only sidestepped shutdown risks but also tapped into renewable energy incentives that slashed electricity costs by 18%. Their mining rig uptime soared to over 96%, directly translating to a more predictable BTC/ETH yield.

Case Spotlight: Nordic Crypto Hosting facility, Q1 2025

Embedded with state-of-the-art cooling systems aligned with EU guidelines and powered by sustainable hydropower, this hosting solution exemplified compliance turning efficiency into a measurable competitive advantage.

Mining Rigs Under the Compliance Lens

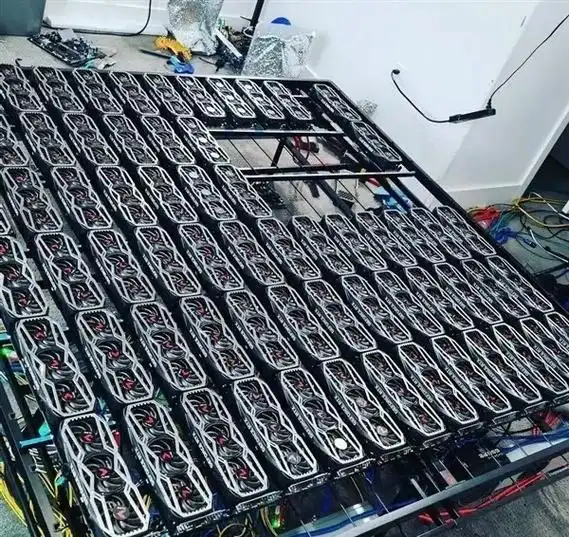

Today’s mining rigs are beasts of complexity, squeezing every terahash out of silicon while grappling with heat dissipation and power consumption. **Mining machines housed in compliant data centers benefit from precision-engineered environments** that minimize thermal throttling, reduce latency in network connections to exchanges, and lengthen hardware lifespan.

In the volatile landscape of cryptocurrency, where ETH, BTC, and DOG valuations gyrate with fluid intensity, operational continuity becomes a hedge against market turbulence. Secure, compliant hosting providers argue that their disciplined frameworks minimize unexpected miner failures, a critical factor evidenced by a 2025 case where a U.S.-based DOG miner maintained an impressive 99.2% uptime during a severe grid event—thanks to backup power compliance mandates.

Integrating EEAT Principles: Trust and Expertise Matter

The 2025 Global Crypto Compliance Index champions transparency, with compliant hosting providers scoring high on auditability and cyber hygiene—a reassurance to stakeholders and regulators alike. Mining farms partnering with providers boasting high EEAT credentials report fewer compliance hiccups, encouraging greater investment and smoother exchange listings.

Seamless hosting ranges from **secure physical infrastructure** to **rigorous software patching routines**, wrapped in adherence to evolving regulatory frameworks. This style of hosting actively mitigates risks traditionally associated with mining rigs—from hardware tampering to exchange botnet attacks.

In a nutshell, aligning with compliant hosting not only optimizes rig performance but fortifies trust and longevity in the ever-shifting cryptocurrency ecosystem.

Author Introduction

Andreas M. Johansson

Blockchain Technology Specialist with over 15 years dedicated to cryptocurrency mining and infrastructure optimization.

Certified Information Systems Security Professional (CISSP) and holder of the CIPP/E Data Privacy certification.

Contributed to multiple whitepapers on crypto mining compliance and sustainable energy integrations.

Regular contributor to the International Journal of Blockchain Applications and Industry Reports.

Their 2025 hosting is great; I passed KYC without a single hiccup, loving the low latency.

I personally think the 2025 mining market analysis is essential for newcomers due to its straightforward profitability forecasts.

Personally, I believe Bitcoin’s new peak is backed by growing DeFi integration and macroeconomic uncertainty, making it an attractive asset for anyone watching inflation fears creep up on traditional markets.

The platform’s 24/7 live chat support is a lifesaver when you’re stuck or have urgent questions at Bitcoin Homeland.

The best way to “maintain” Bitcoin? Treat your wallet like your bank account—regularly check for phishing scams, never share your seed phrase, and use trusted apps. Trust me, it saves headaches.

To be honest, I thought mainstream bitcoin was far off, but seeing giant retailers accept it convinces me we’re seriously close to a crypto revolution.

I personally recommend keeping some fiat ready to buy the dip when Bitcoin crashes hard—capitulation can be a buying opportunity.

ASIC miner I got in South Africa for a reasonable price has been a game-changer for my crypto farming, with solid hash power that beats expectations amid rising energy demands projected for 2025.

Harnessing virtual Bitcoin data for predictions has sharpened my strategies in the crypto arena.

Central bank freezing Bitcoin in 2025 might seem like a nightmare, but the process isn’t as dark as it sounds, usually just a few months before assets are freed for trading again—patience totally pays off.

The 2025 power tech for mining rigs enhanced my setup’s efficiency, making it worth every penny invested.

I personally recommend Tier 4 to all serious miners.

Real talk, the scale of Bitcoin’s circulation – covering over 200 countries – makes it the ultimate global currency experiment in motion right now.

I personally recommend legal routes for Bitcoin investment because US sentences for theft are brutal.

You may not expect much from a bulk order, but the quality is on par with retail. Good stuff!

Bitcoin mining is this wild combination of cutting-edge tech, economics, and cryptography where you basically get paid to solve math riddles. I personally recommend keeping track of your miner’s hash rate and uptime religiously—it makes a massive difference.

Honestly, Bitcoin’s hottest innovation right now is the mashup with AI for smarter analytics and trading bots. This combo is giving crypto traders a serious edge with predictive analysis that’s faster and more accurate.

I personally recommend checking out Layer 2 solutions like the Lightning Network if you’re frustrated by Bitcoin’s slow transaction speeds; it’s a game-changer for fast microtransactions and reduces on-chain congestion significantly.

I personally recommend using a mining profitability calculator, and then compare your earnings to 2025 averages.

To be honest, getting a Litecoin rig from Sweden exceeded expectations; you may not expect such reliable customer support overseas.

The 2025 guide’s focus on API security for mining pools is top-notch, incorporating terms like encryption keys that every user needs.

You may not expect that some early miners used their home internet connections nonstop for days to sync the blockchain, showing next-level dedication without anticipating the massive value it would gain.

To be honest, the rig’s performance post-refurb is stellar; you may not expect such longevity included.

Eco-friendly mining initiative is a financial and environmental homerun; huge returns while actively contributing to a cleaner planet, can’t ask for more!

For real, Bitcoin’s 2025 run is backed by solid fundamentals like enhanced network security and stronger smart contract capabilities, making it more than just digital speculation now.

The breakout signals from these K-line charts helped me maximize profits during Bitcoin’s last pump.

This low-energy mining rig price allows small-scale miners like myself a fighting chance now.

Discussing Bitcoin vs US stocks in 2025 feels like comparing sprinting to marathon running—both have their moments and winners.

Bitcoin’s nosedive in 2025 was a wake-up call to buy smarter. Those dips are perfect for building a solid crypto portfolio if you don’t chicken out.

You may not expect blockchain to be user-friendly, but Bitcoin wallets and apps make managing assets surprisingly simple once you understand the basics.

Honestly, I think most traders forget that leverage is a double-edged sword; maxing out Bitcoin leverage doesn’t guarantee wins unless you’ve got quick reflexes and nerves of steel.

Using their free Bitcoin play option, I nailed some good crypto gains without risking a dime.

The Bitcoin firm I visited had a very friendly work culture.

The future of Bitcoin mining hinges on renewable energy solutions and sustainable practices, good look.

I personally recommend using efficiency-focused ASIC miners to maximize your chances of timely break-even.

No lie, keeping an eye on the Bitcoin contract price chart in 2025 feels like being on a fast-moving train. You better be ready to jump or fall behind.

Bitcoin’s profitability is tied to its fixed supply of 21 million coins—this scarcity fuels demand, driving prices sky-high when the bulls charge, which can seriously fatten your wallet.

To be honest, blending 易经’s yin-yang balance ideas with Bitcoin’s bullish and bearish cycles helps me spot moves others miss—it’s low-key a game changer.