Unlocking Value: Best Practices for Buying Kaspa Miners in Germany

In the rapidly evolving landscape of cryptocurrencies, Kaspa has emerged as a notable contender, captivating the attention of miners worldwide. Germany, with its robust technological infrastructure and prominent crypto community, is increasingly becoming a hotspot for acquiring and hosting Kaspa miners. Unlocking the value in this market requires a nuanced understanding—not only of Kaspa’s technical foundations but also of the strategic considerations that come into play when purchasing mining machines and utilizing hosting services.

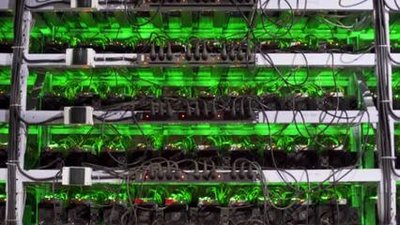

At its core, Kaspa is designed to offer a high-throughput and fully decentralized blockchain, making it attractive to those seeking efficiency and scalability beyond traditional cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). The specialized hardware needed to mine Kaspa typically falls under the category of mining rigs—complex assemblies of high-powered GPUs or ASICs tailored to Kaspa’s unique algorithm. For German buyers, sourcing these rigs involves navigating a landscape dotted with domestic manufacturers, international suppliers, and third-party resellers, each offering varying guarantees in performance, warranty, and aftersales support.

Understanding the intrinsic value of a Kaspa miner means diving into specs like hash rates, energy efficiency, and cooling systems. Higher hash rates typically translate to better mining rewards, but energy consumption is equally pivotal, especially given Germany’s relatively high electricity costs. Innovative manufacturers are increasingly focusing on energy-optimized rigs, which balance power with sustainability—an attribute that resonates well in Germany’s environmentally conscious market.

Beyond the initial purchase, mining machine hosting in Germany offers an alluring proposition. Hosting allows miners to place their equipment in specialized facilities that provide stable power, climate control, and robust security—a stark contrast to the volatility miners might face running rigs at home or in generic office spaces. Not only does hosting eliminate many logistical headaches, but it often includes maintenance services and real-time monitoring, ensuring maximal uptime and profitability. Given Kaspa’s rising difficulty and competitiveness, maximizing operational efficiency through hosting can be a game-changer.

Hosting services come with varying contract models, ranging from pay-per-kilowatt to fixed monthly fees. Savvy buyers compare these plans meticulously, factoring in potential shifts in Kaspa’s network difficulty and market price volatility. Germany’s strong regulatory framework and reliable grid infrastructure generally guarantee uptime and transparency in billing, which inspires confidence in these service providers.

Exploring deeper into the broader cryptocurrency ecosystem, Kaspa’s value proposition in Germany is intertwined with developments in major currencies such as BTC, Dogecoin (DOGE), and ETH. Bitcoin’s legacy as the pioneer has long set the standard for mining operations, with massive farms leveraging ASIC miners capitalizing on the Proof of Work (PoW) consensus model. Meanwhile, Ethereum’s transition towards proof-of-stake (PoS) has sparked interest in alternative PoW coins, and Kaspa’s innovative protocols stand to benefit from this shifting tide.

In this light, miners diversifying their asset portfolios in Germany often allocate hash power across Bitcoin and Kaspa, sometimes even dipping into Dogecoin, which benefits from a passionate community and relatively attainable mining requirements. This diversification strategy mitigates risk—market fluctuations or algorithmic adjustments impacting one coin won’t necessarily parallel across others. Germany’s sophisticated exchanges provide seamless conversion options, allowing miners to liquidate rewards or reinvest in equipment dynamically.

Of course, acquiring a mining rig—whether a state-of-the-art Kaspa model or a Bitcoin ASIC—is not solely about technical specifications and hosting. Regulatory compliance looms large, particularly in Europe’s vigilant oversight environment. German miners must ensure their operations conform to energy consumption guidelines, tax reporting requirements, and data security standards. Partnering with reputable vendors and hosting firms that understand these regulations can make the difference between smooth scaling and punitive disruptions.

Emerging trends highlight a promising synergy between cryptocurrency exchanges and mining operations. Some exchanges now incorporate direct links to equipment providers or even facilitate trade-in programs where users can upgrade rigs for newer models—reinforcing a circular ecosystem. For German users, leveraging these integrated platforms simplifies the purchasing pathway and reduces entry barriers in mining Kaspa and other altcoins.

In conclusion, unlocking the full value of Kaspa miners in Germany demands comprehensive due diligence that spans hardware selection, hosting solutions, regulatory compliance, and strategic diversification within the cryptocurrency universe. Buyers and operators who master this ecosystem not only optimize returns but also contribute to the resilient growth of decentralized finance. In a terrain where innovation races at breakneck speed, informed decisions and partnerships with trusted vendors will continue to be the linchpin of successful mining ventures.

This article delves into the intricacies of purchasing Kaspa miners in Germany, offering invaluable insights on maximizing investment. It highlights effective strategies, from vendor selection to negotiation techniques, while also addressing regulatory considerations. The mix of practical advice and market analysis makes it a must-read for both novices and seasoned investors.